How to automate the payment of your Swiss bills?

Stop repatriating your Swiss francs only to send them back to Switzerland later. Pay your health insurance or your 3rd pillar directly at the source.

Stop repatriating your Swiss francs only to send them back to Switzerland later. Pay your health insurance or your 3rd pillar directly at the source.

Paying a Swiss bill from a foreign bank account often involves international wire transfer fees (SWIFT) and requires an extra currency conversion. The ibani app has an extremely powerful feature to avoid this.

Instead of making your money travel back and forth across the border, discover how to optimize your payments upon receipt of your salary, while maintaining absolute control over your exchange rate.

Let's take a simple example: you earn 6,000 CHF net per month and you have to pay 200 CHF for your monthly health insurance premium.

Configuration is intuitive and only takes two minutes from your ibani app.

1 Manage your IBANs (Your payment routes): Go to the "IBAN" section of the app. This is where you manage your receiving IBANs (the ones on which you receive your funds). Pro tip: internally, we call these "payment routes" because we allow you to associate specific actions with each IBAN to automate everything.

2 Select the IBAN: Pick an existing IBAN (for example, the one your employer pays your salary into) or create a new one dedicated to this purpose.

3 Start adding: In the options for this IBAN, click on the "Add a bill" button.

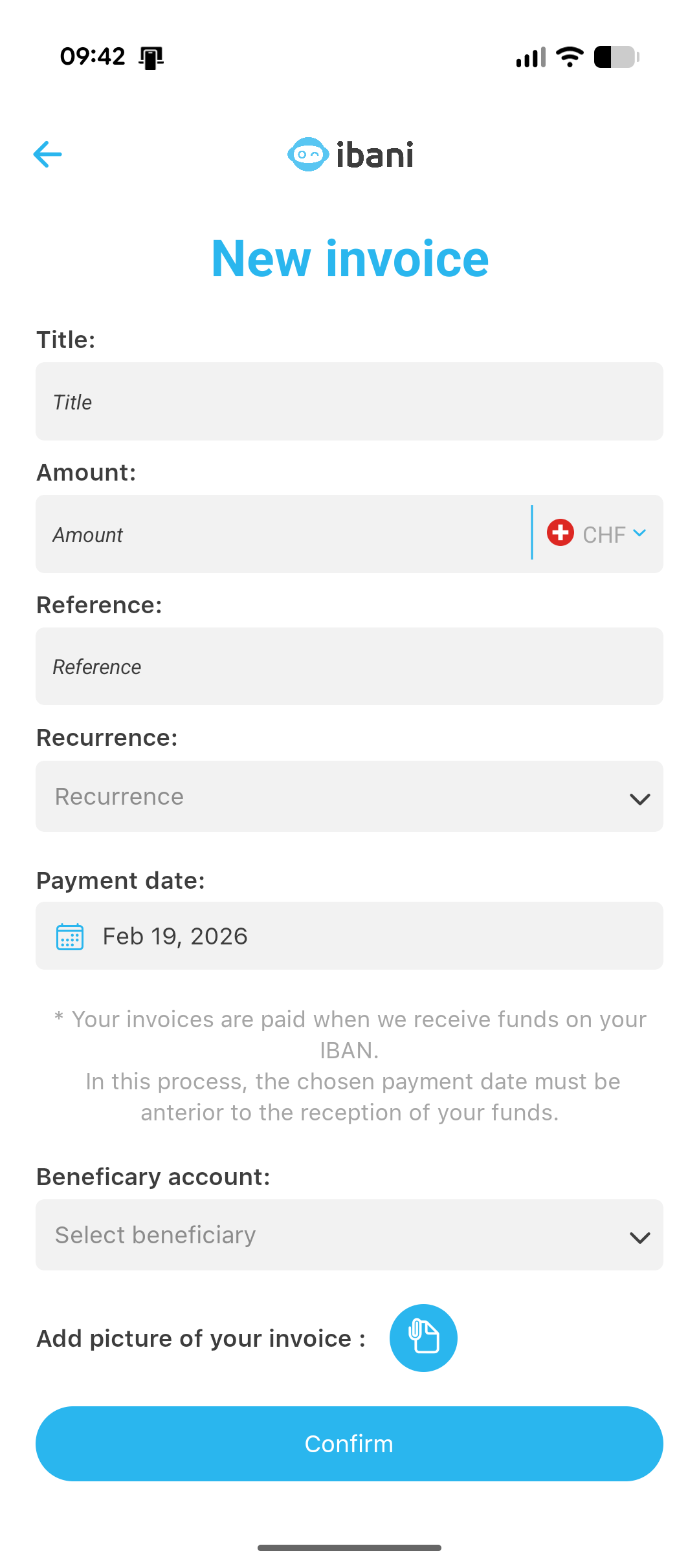

4 Bill details: Customize this operation by giving it a clear Title (e.g., "LAMal Premium"). Enter the exact amount in CHF and choose the recurrence (one-time payment, monthly, or quarterly). Do not forget to provide the reference number (BVR / QR-Bill) in the communication so that the company recognizes your payment.

5 Beneficiary account: Finally, provide the beneficiary account of the bill, whether it is new or existing (Name of the natural or legal person, full postal address, and the Swiss IBAN starting with CH).

During the configuration of your bill (at step 4), the system asks you to choose a "Payment Date". This is where many users make the mistake of trying to guess the exact date their salary will be paid.

Example: You think your employer will pay on the 26th of the month, so you select the 26th. But if HR makes the transfer early and your salary arrives on the 24th, the system will see that the bill date has not yet been reached. The bill will not be paid with this salary!

This feature is not reserved only for health insurance. Here are the most frequent uses by our most expert clients: